dialogues: BENSON TANG

Executive Director, Corporate Travel Community. HONG KONG.

is business travel bouncing back?

According, the latest published data by International Air Transport Association (IATA), the re-bounce of air travel is very strong, and the demand would be even stronger if we did not face the current Ukraine situation and all countries would have opened up

Bear in mind, some governments such as Mainland China, Hong Kong, Taiwan, etc. are pursuing a “Dynamic Zero” policy – restricting flights’ schedules and capacity. In contrast, countries adopting a “Living with COVID” policy have shown strong travel recovery.

In the Asian region, we are advantaged by some new trade initiatives such as Regional Comprehensive Economic Partnership (RCEP) established by 15 APAC countries on 1 JAN 2022 that is expected to be a key motivator for economic growth in this region.

RCEP is the largest Free Trade Agreement (FTA) to date in the world, comprising about 30% of global Gross Domestic Product (GDP) and close to a third of the world’s population. Business travel demand will surely increase due to more business opportunity.

is travel as necessary as it was until a couple of years ago?

“Business is business”: the overall economic situation determines the volume of business travel that is driven by business needs. When a business deal can only be closed by face-to-face meeting, business travel is still required.

At the same time, in comparison with few years ago, new tools provide companies with a wider range of options that reduce the need to travel. For example: company representatives can plan longer trip with more stopovers or substitute non-essential business trip – say for internal training – with ZOOM virtual meetings…on so on.

what motivate business trips now?

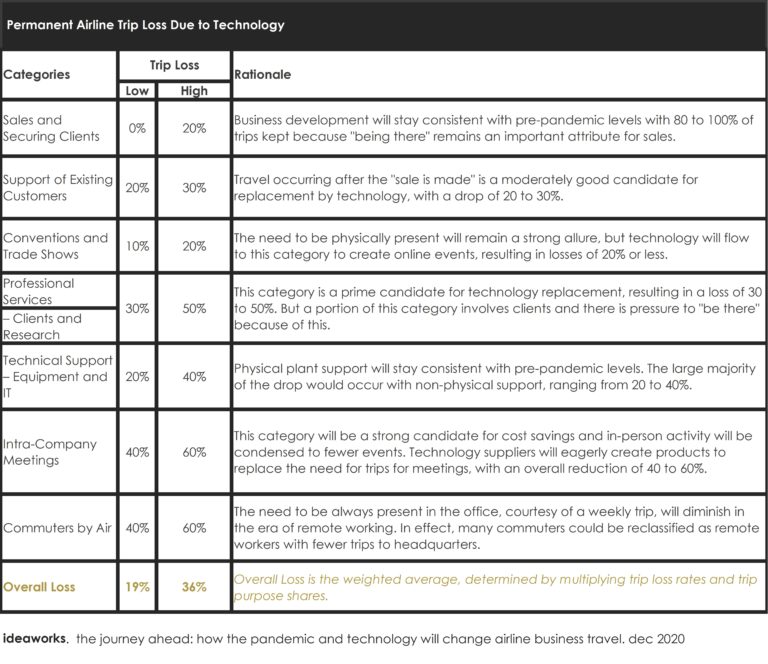

IdeaWorksCompany has studied business trips by Air and broken-down business trips purpose by travel activity. 30% of business trips seem to be motivated by the need to service clients, 45% sales development and clients securing, and a 20 % aimed to work with internal teams.

According to their study, each of these categories of travel will have some loss as result of continuous deployment of technological tools during the last 2 years pandemic.

Supporting what said earlier, ‘sales development and securing clients’ is projected to see between a 0-20% trip loss, as “business development will stay consistent with pre-pandemic levels.

‘Being there’ remains an important attribute for sales”.

Meanwhile, intra-company meetings are expected to record losses between 4% and 60% and become a target for cost saving as in person activities will be reduced to fewer events.

Similarly, commuting by air is projected to be robustly reduced as workers commuting weekly to be in the office, will likely become remote employers required to make fever trips to the headquarters.

As result of these changes airlines are projected to see a reduction in business trips between 19% and a 36% , say one out of three business trips by air will be lost as direct consequence of new technologies adoption.

research conducted by SKIFT at the end of 2021 highlight worries among business people together with a resistance to travel again for business. this year, events in Ukraine have added to the already gloomy climate, and curbed recovery expectations. what is the sentiment among business travellers and companies who send their representatives to other countries for work?

According to the latest survey within the travel managers community, nervousness about Omicron has began to wane and global travel restrictions are loosening up. We are observing a continued improvement of corporate travel, especially since the second quarter of 2022.

More than four in five (82%) poll respondents feel their employees are “willing” or “very willing” to travel for business in the current environment, compared with 64% in the January 2022.

The confidence of traveling is growing— consumer confidence is now at the highest level since the start of the pandemic.

tests, quarantines, reduced capacity, duty of care. is traveling for business more expensive now? would costing affect the volume of business travels?

Certainly, traveling in the time of Covid represents a hardship.

Companies today have a duty of care towards their employees and need to consider the opportunity to introduce allowances and incentives for their traveling staff as well as making sure the travel itself is ‘safe’. These are ‘necessary’ costs.

In addition, energy prices were already increasing prior to the Ukrainian crisis, heavily impacting the cost of travel.

Nevertheless, we need to keep in mind that cost retention is one thing, but business revenue is another.

In the definition of their annual travel budgets, corporations don’t focus only on costs. When business travel is proved to enhance corporations’ revenues, travel budget tends to increase.

is ‘bleisure’ on the rise? do you observe a ‘consolidation’ of trips blending business and leisure as a result of the complexities of travel?

Before COVID, “Bleisure” was undoubtedly a heat topic in corporate travel world. However, because of COVID, the situation has changed due to objective complications.

Many countries are implementing extra quarantine measures and introduced policies regulating the number of people gathering in public places or dining at the same table in a restaurant.

Furthermore, travel insurance coverage also is an issue.

All these factors diminish the appetite for “Bleisure”. Nevertheless, my personal view is that once the severity of COVID will diminish in the future, “Bleisure’ will revive.

which are trends do you feel will be emerging from the current situation?

“Sustainability” will be the future. Green energy and sustainable fuel will play pivotal role in corporate travel. COP 26 in Glasgow last NOV motivated countries around the world to speed up the reduction of carbon emission.

Governments around the world seem to be determined to reduce carbon. Stricter governments policies will roll out, such as Carbon Tax, Carbon Trading, Carbon Offset…etc.

Business travel is one of the major carbon emission sources. Some authorities for example London Stock Exchange requires major listed companies to provide annual ESG report as a mandate requirement. Therefore, travel managers will need to pay attention in this area. In our foreseeable future, when sourcing corporate travel suppliers (no matter airlines, ground transportation …etc.), travel managers will be obliged to take into consideration all these unprecedented factors.